The most common questions about carbon projects that are asked by the community.

About carbon farming

In carbon farming, we refer to carbon insetting when a farm sequesters carbon in vegetation or soil that aims to match the emissions the farm production generates. Carbon offsetting is when the carbon is sequestered elsewhere, and the farm or business buys carbon credits to offset its own emissions.

Learn more about the differences between these processes for a livestock enterprise on the Meat and Livestock Australia website.

Co-benefits are the additional benefits achieved from carbon farming on top of the main goal of reducing emissions. These benefits are generally classed as financial, social or environmental:

- financial benefits from generating and selling Australian Carbon Credit Units, diversified farm income, improved productivity and improved farm infrastructure

- social benefits include increased employment opportunities, resilience for regional and First Nations communities and improvements in general farmer wellbeing

- environmental benefits include increased biodiversity, soil health, pollination and pest control, and resilience to drought and flood.

Learn about carbon farming’s co-benefits on the NSW Department of Primary Industries website.

Carbon farming should be considered an additional revenue stream and part of your overall farm business strategy. The type of carbon method you choose should complement your strategy and the landscape of your property.

For rural properties in NSW, there are primarily two types of carbon farming methods:

- Agricultural methods include managing carbon in soils or reducing the amount of potent greenhouse gases like methane or nitrous oxide from livestock, manure management and fertilisers.

- Vegetation methods include reforestation through new tree plantings, protecting native forest or vegetation from clearing, farm and plantation forestry and tidal restoration of coastal wetland ecosystems.

Where to start when planning a carbon project

The suitability of a carbon project depends on your land type and conditions and the long-term motivations and objectives for your land, property, business and family.

Projects that sequester carbon will require at least a 25-year commitment, which means you will need to think ahead when planning the future of your land, farm and enterprise.

If you are considering a carbon project and want to assess your suitability, visit the NSW Local Land Services website.

Australia, the Clean Energy Regulator (CER) manages the Australian Carbon Credits Unit (ACCU) Scheme. The Scheme establishes a carbon abatement market, allowing landholders to participate in and earn Australian Carbon Credit Units (ACCUs) to sequester carbon in vegetation and soils or avoid emissions entering the atmosphere.

When considering or planning a carbon project that can earn carbon credits, you must check your eligibility to participate in the ACCU Scheme.

The CER requires potential participants to meet several legal and financial criteria before entering the ACCU Scheme. Before doing any activities on site, you must understand your legal right to carry out a project on your land under the ACCU Scheme and the Scheme’s eligibility and newness requirements.

You can check your eligibility for the ACCU Scheme using the ACCU Scheme Questionnaire.

For more information on planning a carbon project, visit the Clean Energy Regulator website.

A carbon project must be registered with the Clean Energy Regulator (CER) under the Australian Carbon Credits Unit (ACCU) Scheme. There are several methods – a set of requirements and rules for running a project – under the Scheme. Projects under methods reduce emissions or store carbon in soils and vegetation.

The length of a carbon project depends on the method you use. For example, the beef herd management method is in place for seven years, while vegetation methods can last up to 100 years. You must consider how the duration of your project affects your future land and farm management planning.

Learn about the different methods and their timeframes on the Clean Energy Regulator website.

You can manage the carbon project yourself and/or outsource its management.

You must meet the Clean Energy Regulator’s (CER) specific requirements when registering and implementing a carbon project. These include completing paperwork, conducting baseline tests and reports, and seeking legal and financial advice. You may need to outsource some of these activities, which will cost you money upfront.

You also have the option to outsource management to carbon service providers for specific activities or the entire project lifecycle. They can charge an upfront fee or a portion of the project income over time.

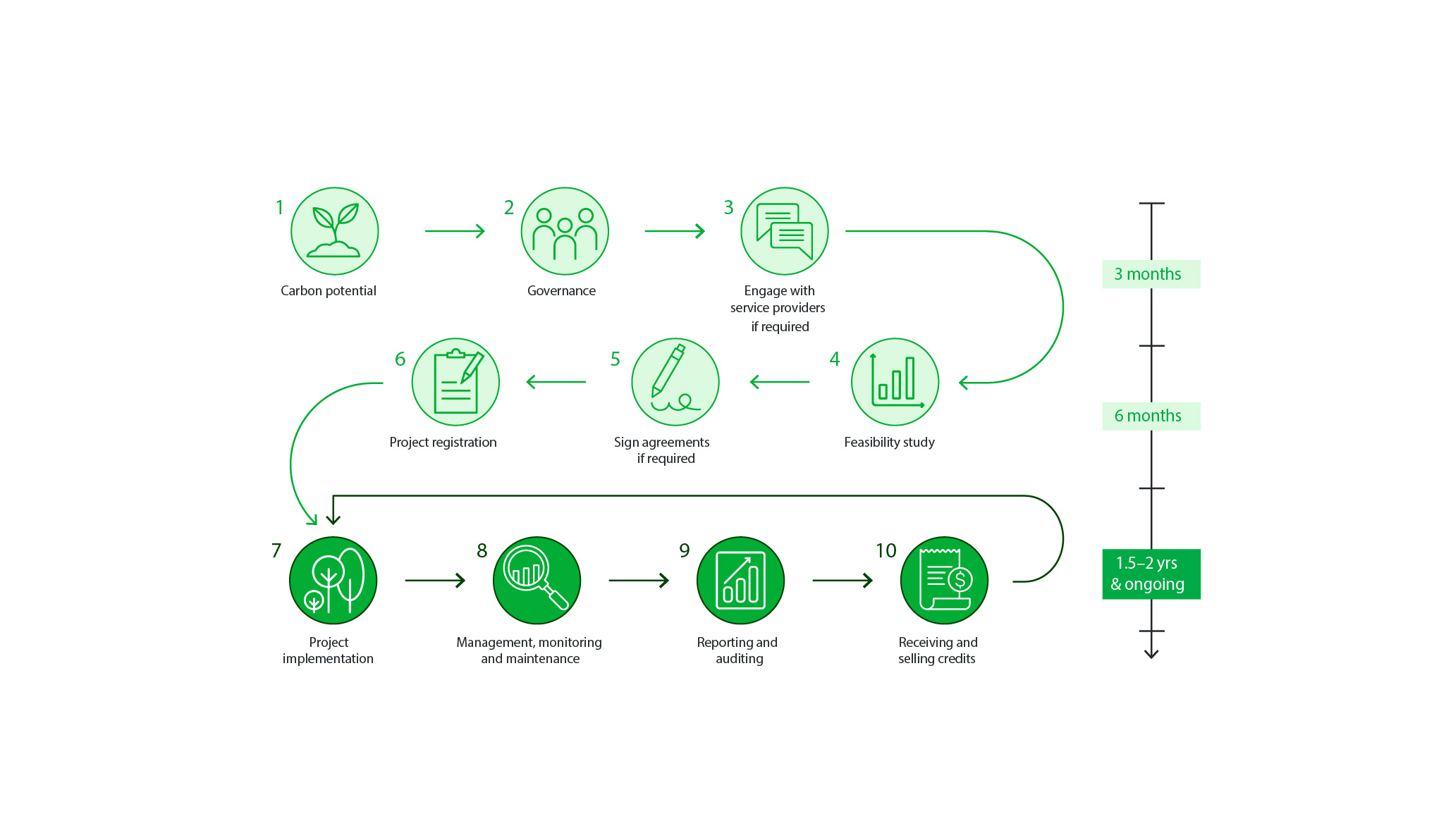

This graphic is an example of a revegetation project featuring all the steps in the registration and implementation processes, including the step where you can engage a carbon services provider.

A registered carbon project can be a secondary or diversified source of income for a farm. This is evident when a carbon project is from a part of the farm and is considered marginal or non-viable for other farming purposes.

There are tax considerations when implementing carbon projects, including:

- Clean Energy Regulator:

Tax rules that apply to Australian carbon credit units

- Australian Tax Office:

Taxation of Australian carbon credit units for primary producers

Taxation information for holders of primary producers registered emissions units (PPREUs)

Information about water and carbon sequestration rights classed as capital gains tax assets

- Australian Investments & Investment Commission (ASIC):

An overview of the regulation of financial services in Australian Carbon Credit Units (ACCUs) for financial advisers and developers

Potential earnings from a carbon project will depend on the carbon farming method you adopt and the potential carbon abatement you achieve for the property, which is highly dependent on factors such as climate, soil type and land management.

You can use the Landscape Options and Opportunities for Carbon Abatement Calculator (LOOC-C) tool to identify possible Australian Carbon Credit Unit (ACCU) Scheme methods that you could use for projects on your property and estimate the Australian Carbon Credit Units (ACCUs) that could be generated over the period of a carbon project.

To assess potential earnings from a carbon project, you will need to consider:

- the associated project costs, which can vary significantly between methods

- the associated changes to on-farm productivity, which can be highly dependent on local conditions

- the value of past trends in Australian Carbon Credit Unit (ACCU) spot price. ACCUs can also fluctuate like any other traded commodity.

Each carbon project and Australian Carbon Credit Unit (ACCU) Scheme method will have different income generation potential and timeframes. Your project agreement with the Clean Energy Regulator (CER) will set out the project's duration, with some projects setting out monitoring and crediting timeframes and periods. The timing of income is affected by when the carbon credits are generated and sold. This will be different for each project.

Your carbon project sequesters (stores) carbon, earning Australian Carbon Credit Units (ACCUs). The Australian Government will hold the carbon credits in an account for you until you either sell them or decide what to do with them.

You can sell your ACCUs in several ways:

You can sell your carbon credits through an auction. These auctions allow you to bid for a carbon abatement contract, giving you the option but not the obligation to sell your carbon credits at a set price to the Commonwealth. Selling ACCUs at a set price provides price security.

You can sell your ACCUs to buyers in the secondary market. You can sell ACCUs to other purchasers, including businesses and state governments, through a fixed commercial agreement or on the spot market at the prevailing market price.

A key component of the Australian Carbon Credit Unit (ACCU) Scheme is that any crediting of carbon abatement must meet the requirements of newness. This means that carbon credits generally cannot be claimed for existing vegetation, as the carbon sequestration resulting from this vegetation would have happened anyway.

You can learn more about a project’s eligibility under the ACCU Scheme on the Clean Energy Regulator (CER) website.

To be eligible to participate in a carbon project under the Australian Carbon Credit Unit (ACCU) Scheme you must meet eligibility and newness requirements. For a reforestation project, this means you must not have started:

- preparing the soil for seeding or planting for the project

- seeding, planting or fertilising plants for the project

- installing an irrigation or drainage system for the project.

If you have already started reforestation works on your property, you would not be eligible to earn carbon credits under the Australian Carbon Credit Unit (ACCU) Scheme. However, if your land has been clear of woody vegetation for the last 10 years, you could be eligible for new activities under one of the vegetation methods.

The NSW Spatial Services has online tools to help you plan and assess a property for carbon potential, including:

- SIX Maps Viewer allows you to search for a property by address or Lot/DP and identify the address or Lot/DP(s) using a query or point-and-click function. You can also slide between aerial imagery and a standard road map and measure distances and areas.

- Historical Imagery Viewer provides access to aerial imagery across NSW dating back to the 1920s. If you don’t have documented records, this can be useful for identifying evidence of historical land clearing or land uses.

- NSW Planning Portal Spatial Viewer can search a property by address or Lot/DP, identify a range of planning matters related to the property, and generate a property report. You can access information about a property on:

- Local environmental plan zonings and permissible land uses

- identified hazards and risks from bushfires and floods,

- environmental and heritage protection

- Local Aboriginal Land Council areas

- Other legislative instruments that may apply to the land include state environmental planning policies.

- Trees Near Me NSW identifies the native Plant Community Types (PCTs) for a given area, which includes the plant species of each community and their relative importance in terms of abundance, including number of species and cover and how much of the area they occupy. It also identifies Plant Community Types (PCTs) and the extent to which they were predicted to occur before land clearing. This information can be valuable when planning a vegetation project.

- eSPADE provides NSW soil profile and soil map information, including soil type, land capability maps, and modelled soil properties such as soil organic carbon concentration and stocks, cation exchange capacity, clay proportion and bulk density.

- NSW Spatial Collaboration Portal has NSW spatial tools and datasets, including planning and administrative boundary layers, flood and fire mapping, and elevation and slope information.

- NSW Spatial Information Exchange (SIX) gives you access to Survey Mark sketches and the Clip & Ship tool for downloading topographic and cadastral spatial data.

These resources should be used as a guide only. Before entering any contractual agreements, you should still seek expert advice, including legal, financial and technical.

To find suitable service providers to outsource specific project activities or the entire project lifecycle, visit the Carbon Market Institute Marketplace Directory website.

The Avoided Clearing of Native Regrowth method was closed to new projects in February 2023. Find out more on the Clean Energy Regulator website.

Australia has now joined other countries in considering the suitability of a carbon border mechanism as part of its climate approach. Carbon Border Adjustment Mechanisms (CBAMs) apply fees on goods based on their carbon footprint. Many countries argue that a carbon border adjustment as a pricing mechanism will help accelerate emissions reduction, as less emissions-intensive products will pay less of a fee at the border.

For Australian agricultural producers and exporters, this means measuring their emissions and either reducing them, offsetting through their own property, or purchasing offsets to minimise the border adjustment cost and maintain access to overseas markets.